If you run a business, and employ at least one person, paid via a PAYE scheme, automatic enrolment duties will apply to your business. Below are the main high level steps that you should consider when tackling auto enrolment. There are a whole myriad of things to comply with and consider, over and above the steps detailed out below. Due to this, and because rules and regulations are always changing it is always worthwhile getting up to date expert advice.

- Check your company staging date

- This can be checked at http://www.thepensionsregulator.gov.uk/employers/staging-date.aspx

- Enter your PAYE Reference number, and you will then get your staging date

- Nominate a contact

- This will allow the Regulator to liaise with the correct person

- Assess which staff should be put into the pension scheme

- This is based on age, and how much is earned

- Remember it’s against the law to try and persuade staff to opt out of,or leave a pension scheme

- Check that you have accurate staff records, to ensure smooth running of payroll

- Dates of Birth

- Salaries

- NI Numbers

- Contact details

- Contribution amounts to be paid into the pension

- Check that your payroll provider / payroll system can cope with auto enrolment requirements

- Write to all staff within 6 weeks of staging date (if not before)

- Choose a suitable pension scheme, that is suitable for both the business and staff

- At staging date, opt in all relevant staff

- Ongoing Duties to avoid penalties

- Keep records

- Monitor ages and earnings of new and existing staff to check automatic enrolment eligibility

- Enrol staff and write to the as appropriate

- Pay contributions to the pension scheme.

- Within 5 months of your staging date you must complete a declaration of compliance, After three years you must re-enrol all eligible staff into the pension shceme if they aren’t already members

- This is a legal duty

Do you want to know more, or can we help you, please contact us

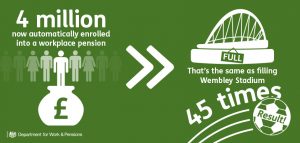

Photo Credit

© dwp.gov.uk | CC Licence